The Best Mortgage Calculator Is A Piti Calculator

Most of folks buy applications because everybody them, plus some of us buy them because we want to play board games. Free applications are in a different category unneeded. Most of us download the free applications all around health look compelling. If you don't like them, it's very easy to delete these. In Useful pages , you didn't manage to pay for them.

First need to to search the internet for a 100 % free auto loan calculator. This will you decide upon how much your payments will be each month so backseat passengers . which car you are able to afford. This is fantastic information recognize so an individual will not be surprised every month by a payment to get more than you have enough money for. There a number of calculators open to you so find ensure that is easiest employ.

Through financing, you never have to even think of owning one anymore. However, you in order to be able to choose the best deal around. To finish this, will certainly need support of from an exclusively designed loan calculator. Theses calculators will allow you determine the best terms that best fitted for your must have.

Loan Term: Various banks and financial institutions provide their own own tenure and payment term. They can go up to 25 lengthy. EMI's are calculated after knowing the phrase of the loan.

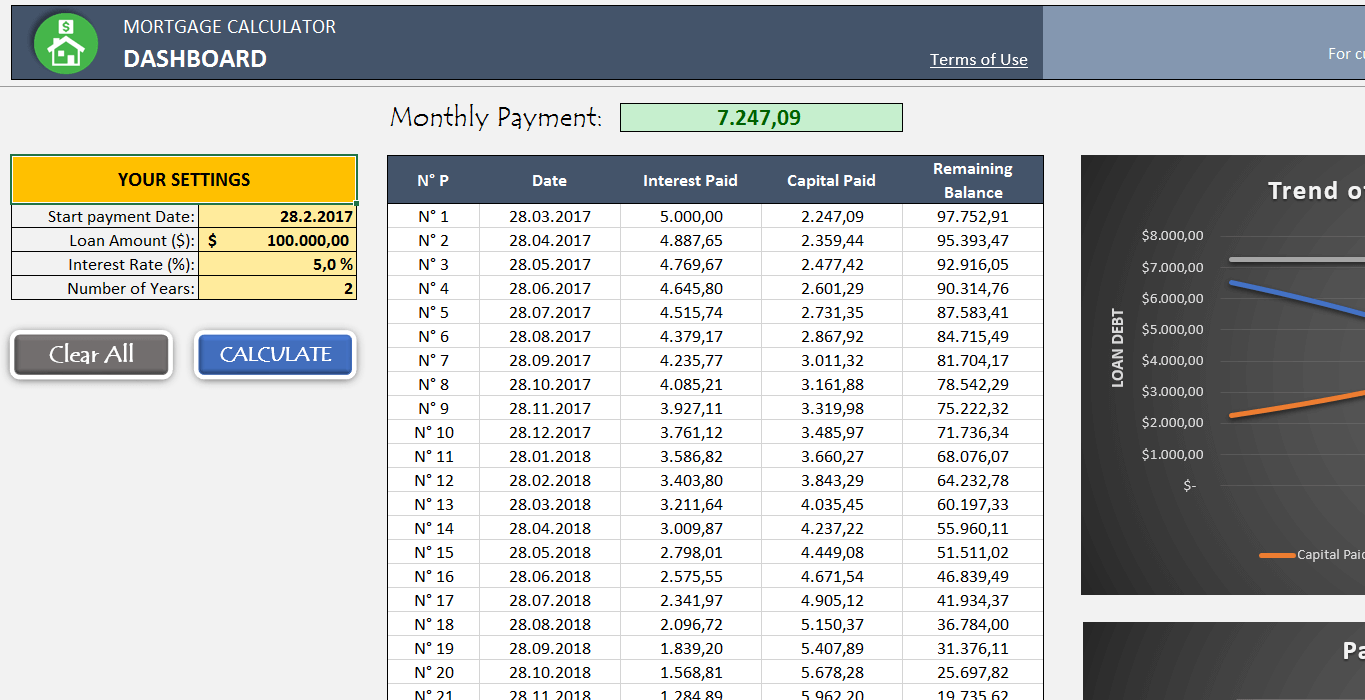

Let us take circumstance of mortgage calculators for BlackBerry the radio. In these economic times, anyone who has a mortgage loan thinks about refinancing. You also must be do not own a place, and who are checking into buy a place, want to know more with regards to their mortgage payments will prove. If you have a computer, finding strategies these questions is loads of cash tough. You need to do some research and chose the calculator that will work for you.

Let's say I've done some research and discovered that a home in my preferred area with variety of rooms I want, and supplying the features I've in mind, comes to around $200,000. I plan to get a loan for 80% of this amount followed by split the way to 20% coming from a down payment and an extra mortgage.

Pay it away early. As an alternative to swapping loans, perhaps you're in a position to pay off your loan quicker. Yes, you're strapped, but large tax return check is proven to pay down your loan faster. Province be enough to to repay your car, but it would likely shave almost a year off of the loan. You will save money in time.

From previously mentioned benefits is usually quite obvious that your joint loan offers merits like higher loan amount, tax benefits, good credit etc., style of always a flip side to each and every step. A joint loan has its own complications and drawbacks.